Writing Assignment 1¶

\(M/P = Y \times L(i)\).

If \(L'(i)\) is large, a given change in \(i\) requires a large offsetting change in \(Y\). The LM curve is flat. Simple check: if \(L'(i) = 0\), then the LM curve is vertical (the same \(Y\) solves LM for any \(i\)).

Intuition: When \(L'(i)\) is high, a given change in \(i\) reduces money demand by a lot. Money supply is fixed. Restoring money market clearing requires a large reduction in \(Y\) (transactions demand).

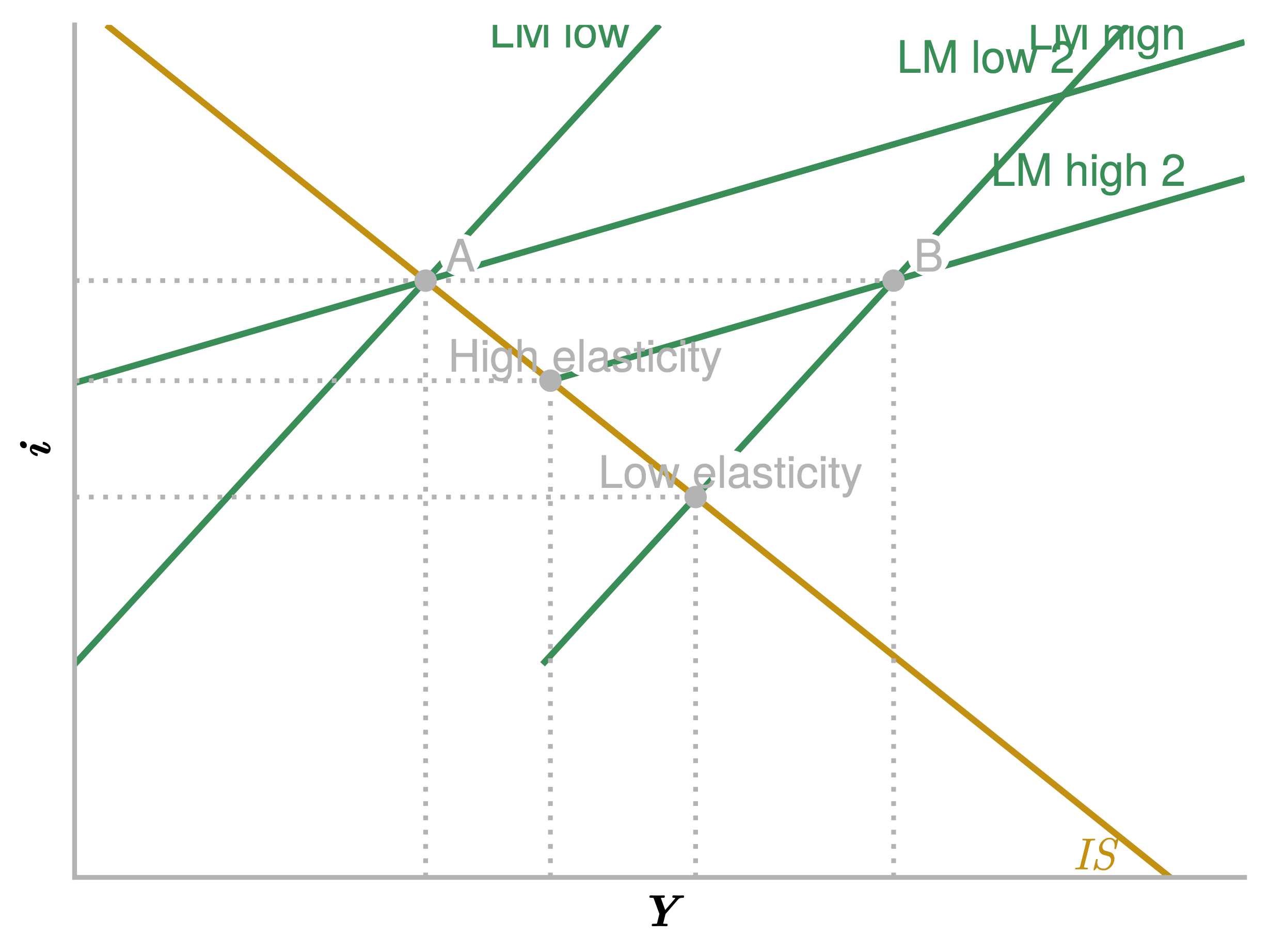

Monetary expansion¶

The right shift of \(LM\) is not affected by the slope of \(L\). The following graph represents the effects of higher \(M/P\) for flat and steep LM. Clearly, a steep LM curve implies a large change in \(Y\). Financial innovation makes monetary policy less effective.

Intuition: When \(M\) rises, households have too much liqudity. They buy bonds, driving down \(i\). When \(L'(i)\) is high, a small decline in \(i\) is sufficient to induce households to hold the additional liquidity. Then transmission to the real sector is limited (\(i \downarrow \implies I \uparrow\)).

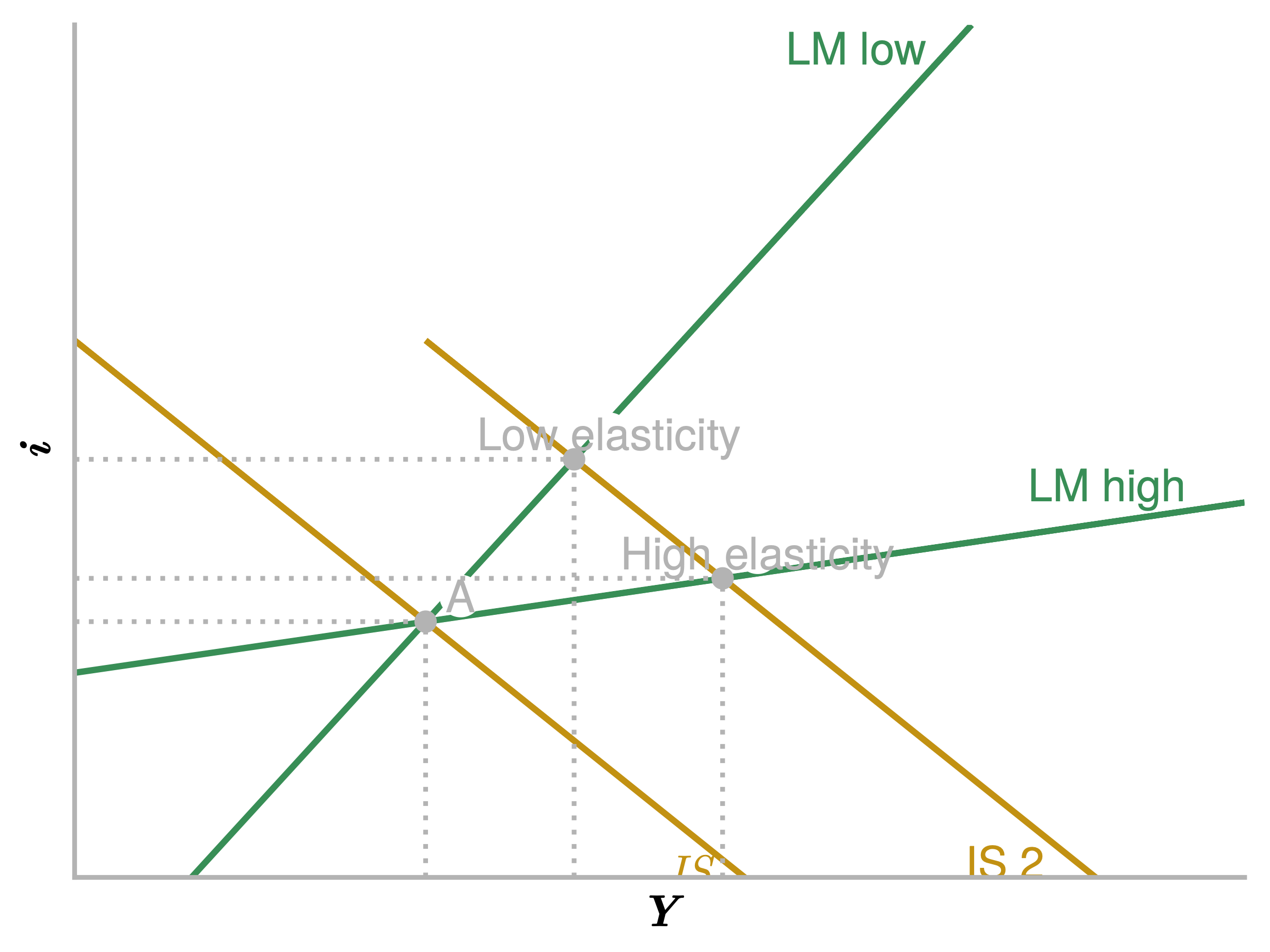

Fiscal expansion¶

The right shift of IS is clearly not affected by the slope of LM. The graph (below) shows that a flat LM curve makes fiscal policy more effective.

Intuition: When \(G\) rises, output rises and households need more liquidity. They sell bonds and \(i\) rises. That crowds out investment and reduces the effect of \(G\) on \(Y\). If a small rise in \(i\) is enough to convince households not to hold liquidity, the crowding out effect is small.