Term Paper Writing¶

Econ520 - Spring 2023 - Prof. Lutz Hendricks¶

Learning Objectives¶

- Find, select, and organize a literature.

- Distinguish good sources from bad ones.

- Identify the main arguments and stay away from the side-shows.

- Summarize arguments concisely.

- Avoid excessive detail, but make sure the reader understands how each argument is supported.

- Weave a narrative.

- Practice scientific writing.

- Avoid editorializing.

- Write with precision and without prejudice.

What Makes a Good Topic?¶

We are looking for a question that is under active debate.

The topic needs to be fairly narrow.

Examples:

- Too broad: Why did income inequality rise over time?

- Better: Focus on one cause, such as international trade. Perhaps even narrow it to trade with China.

- Too broad: What are the implications of a flat tax?

- Better: Would a specific flat tax proposal substantially increase income inequality?

Avoid questions of the form: "How does endogenous variable X affect Y?" Such questions are tempting, but don't work logically. Example:

- How does the decline in U.S. manufacturing affect productivity growth?

- The answer depends on why manufacturing declined (the shock). The decline itself is an endogenous response to a shock. It makes sense to ask: "What is the effect of the shock?" It usually does not make sense to ask: "What is the effect of an endogenous response to a shock?"

- To be specific: Suppose the shock is regulation that makes investing in plants and equipment expensive in the U.S. Its effect would likely be different from structural change on the demand side (as people get richer, their demand shifts towards services).

- Sometimes questions like this can work, though. For example, you could ask: "How does the decline in manufacturing affect employment in rural America?" This might work because the effect does (likely) not depend on why manufacturing declined.

Possible Topics¶

I strongly encourage everyone to pick a topic from the list below. If you would like to study a different topic, talk to me.

Why Do Europeans Work Less Than Americans?¶

"Hours worked per person are on average 14 percent lower in Europe than in the United States" (Bick et al 2019, p. 1383).

What causes the hours gap? Specifically: are higher taxes to blame?

References to get you started:

- Bick et al. (2020). "Why are Average Hours Worked Lower in Richer Countries?"

- Conesa and Kehoe (2017). "Productivity, Taxes, and Hours Worked in Spain."

- Bick, Alexander, Bettina Brüggemann, and Nicola Fuchs‐Schündeln. "Hours worked in Europe and the United States: new data, new answers." The Scandinavian Journal of Economics 121, no. 4 (2019): 1381-1416.

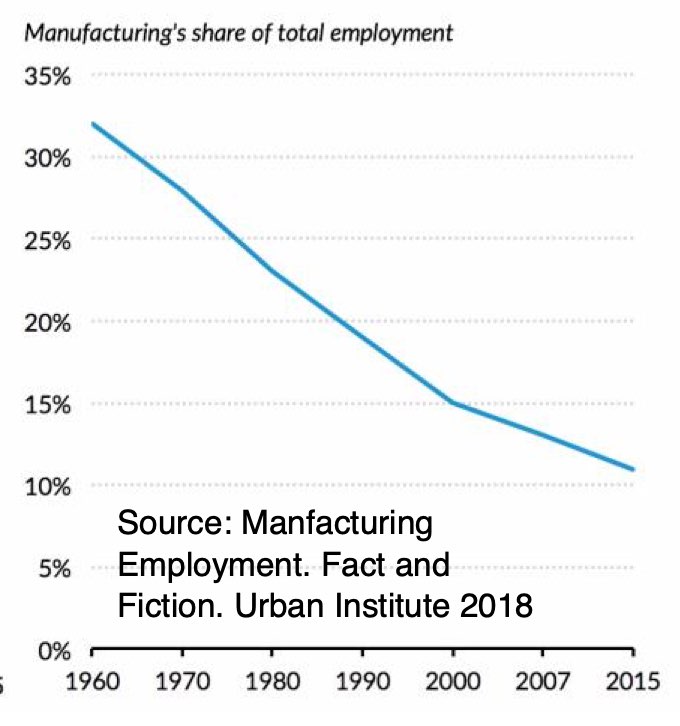

Why Has U.S. Manufacturing Declined Over Time?¶

References to get you started:

- Fort, Teresa C., Justin R. Pierce, and Peter K. Schott. "New perspectives on the decline of US manufacturing employment." Journal of Economic Perspectives 32, no. 2 (2018): 47-72.

- Pierce, Justin R., and Peter K. Schott. "The surprisingly swift decline of US manufacturing employment." American Economic Review 106, no. 7 (2016): 1632-62.

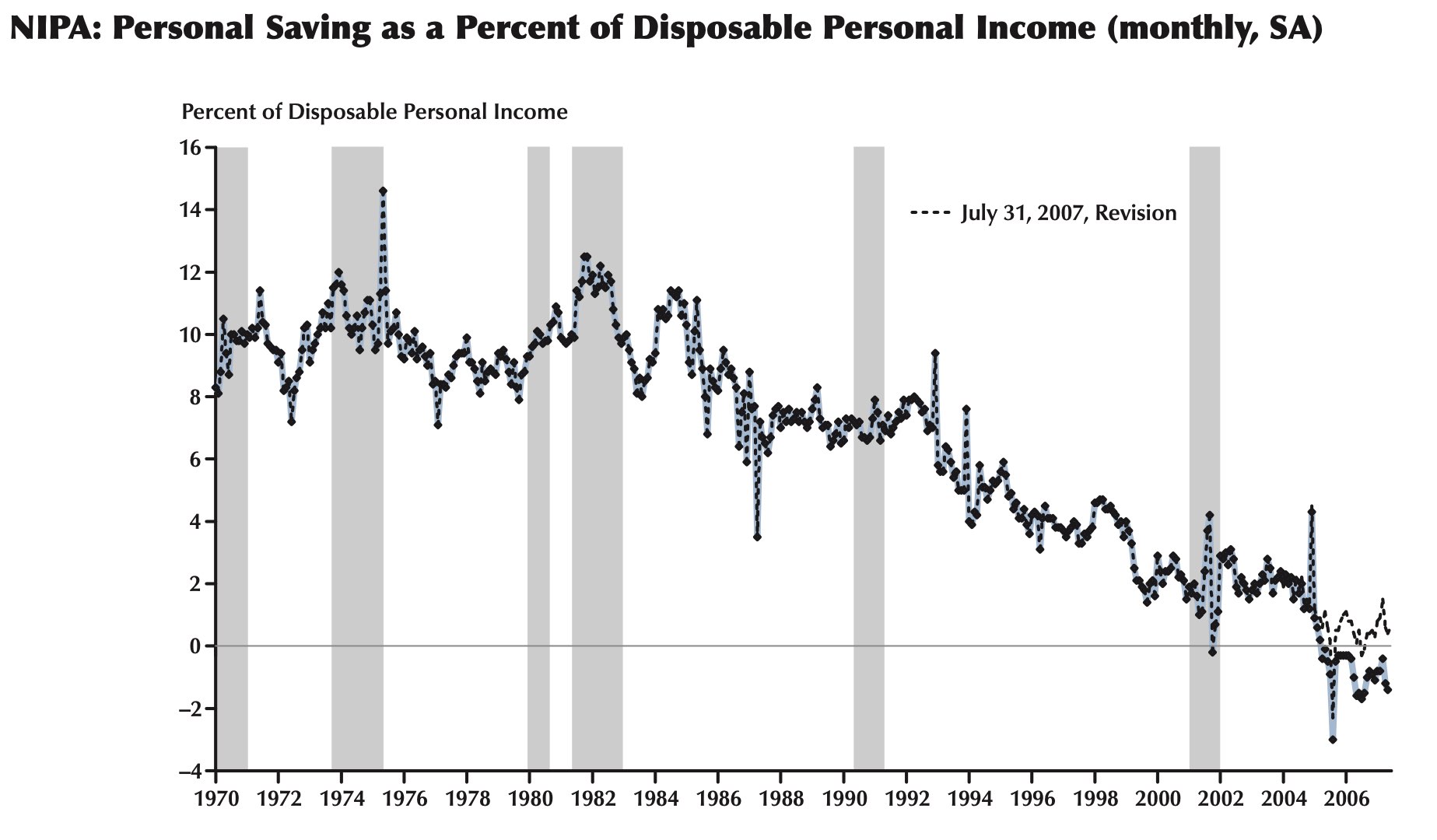

Why Has the U.S. Saving Rate Declined?¶

Source: Guidolin, Massimo, and Elizabeth A La Jeunesse. 2007. “The Decline in the U.S. Personal Saving Rate: Is It Real and Is It a Puzzle?” Federal Reserve Bank of Cleveland Review, 1–24.

References to get you started:

- Bloomberg Dec 2022

- NY Times Dec 2022

- Economic Report of the President, 2006, 2010

- Washington Post Dec 2022

- NY Fed Current Issues 2000

- "The Decline in the U.S. Personal Saving Rate: Is It Real and Is It a Puzzle?" Guidolin and La Jeunesse 2007

- Gale, William and John Sabelhaus, 1999, "Perspectives on the Household Saving Rate," The Brookings Papers on Economic Activity, 1, 181-214. http://www.jstor.org/stable/2534665

What Causes Jobless Recoveries?¶

After recent recessions, employment has stayed low for long periods of time. What are the causes of the "jobless" recoveries?

References to get you started:

- Jaimovich, Nir, and Henry E. Siu. "Job polarization and jobless recoveries." Review of Economics and Statistics 102, no. 1 (2020): 129-147.

- Graetz, Georg, and Guy Michaels. "Is modern technology responsible for jobless recoveries?." American Economic Review 107, no. 5 (2017): 168-173.

- Natalia A Kolesnikova , Yang Liu. "Jobless Recoveries: Causes and Consequences." Regional Economist, Federal Reserve Bank of St. Louis, 2021

- "Is Automation To Blame For Jobless Recoveries?" Forbes, 2017

- Washington Post Sep 2013

- Federal Reserve Bank of SF June 2009

Finding Source Material¶

Academic journal articles are generally hard to read. Feel free to look, though, and you will get an idea what professional economists actually do.

I maintain a short list of more accessible resources, such as Fed Economic Letters.

I would generally avoid:

- political sources that push a partisan view (Heritage Foundation; Congress; Cato Institute)

- non-reputable sources (blogs)

- academic working papers (except recent NBER working papers); to avoid third rate scholarship

- acadmic articles from third rate journals

- very brief surveys that lack detail

Example Topic: Taxing wealth¶

Topic idea: what are the pros and cons of taxing wealth?

Think about this some more and questions arise:

- taxing wealth compared with what alternative?

- for what objective?

One way of finding out is to search "pros and cons wealth taxation". This yields a lot of unknown sources, such as taxry.com, taxlinked.net (the top hits as I write this). Those probably don't help us much. But they may help to better focus the topic. So, clicking on the not-so-promising politicallyincorrecthumor link actually produces a long list of arguments that we can use. Some insights from those arguments:

- Two goals are: redistribution and reduced concentration of political power.

- There are practical implementation issues: how to measure wealth, tax evasion, administration costs...

- There are efficiency concerns: entrepreneurs may have to sell businesses; capital allocation may suffer; capital flight.

We can use these arguments to improve focus. Let's say we focus on the goal of redistribution and set aside practical implementation issues (which may be very technical). Then it may be natural to ask: is a wealth tax a more or less efficient way of redistributing resources than the obvious alternative, a progressive income tax?

Our next search might be "wealth taxation redistribution efficiency". Now we start to see better sources (think tanks and academic articles). But it's hard to get anything at the right level. The next step is to search promising sources directly.

- searching the JEP for "wealth tax" yields "Taxing our wealth" by Scheuer and Slemrod (useful)

- Brookings yield (as expected) a whole list of articles

- Google scholar also links directly to Brookings and Fed articles (perhaps easier than searching sources separately). But there are also a lot of (often third rate) academic articles; so watch your sources.

The next step is to read through the most promising articles and follow up on the references cited therein. This allows us to refine the question and likely narrow it further. Perhaps something along the lines: is taxing wealth more or less harmful for small businesses than taxing income? But then, that might be too narrow and we don't find enough material. Then we need to go a little broader. It's an iterative process.

Notes on Writing¶

Cite your sources.

When you make a claim, back it up. Every time.

Use scientific citation styles.

In the text: "Smith (2020) says Blah."

In the bibliography: "Smith, Martin (2020). The Title. Journal of Economic Perspectives 3(4): 15-20".

Simply listing URLs is not informative. The reader has no idea what is behind a URL without clicking through each one.

Nice words come last.

First decide what you want to write. Outline that. When you are happy with the substance, fill in the words.

Visual structure.

There should be (sub-)headings that let the reader see at a glance how the document is structured.

Explain how conclusions are reached.

Saying "A study by X showed that increasing top marginal taxes reduce income inequality by Y" is not all that informative by itself. Try to explain:

- How was that conclusion reached?

- Why do other studies disagree?

- What are the limitations of the paper's approach?

- How does identification of cause-effect work?

Weave a narrative.

You don't want a laundry list of "A says X, B says Y, ...". Instead, it is better to have:

"The main disagreements are about X and Y. On X, A says XA and backs it up as follows ... But B says XB and supports it as follows ..."

Related: Rather than separately summarizing the arguments pro and con, it is usually better to summarize how both sides view each argument.

Example: Do minimum wages cost a lot of jobs?

- A con argument (no pun intended) may be: we don't see evidence in cities that have increased minimum wages.

- Those who hold the pro view may counter: there is a selection problem. Only cities where employment effects are small raise minimum wages.